Carbon Credits: The Opportunities on the Pathway to Net Zero

Thursday, 10/08/2023 09:00 (GTM +7)

Business See an Opportunity in the Carbon Credit

As the world grapples with the devastating effects of climate change, the carbon credit market is a potential game-changer and offers financial rewards. By embracing this potential market, businesses can help combat climate change and drive sustainable growth and innovation.

The Advanced Solutions for Reducing Carbon Emissions

Carbon credits are government-issued licenses that permit the regulated burning of hydrocarbon fuel. The carbon credit markets typically involve governments, NGOs, businesses, and individuals. When the Kyoto Protocol was signed in 1997, a carbon market allowed countries with the right to excess emissions to sell or buy from countries that emit more or less than the committed target.

Carbon credit key highlights:

- A carbon credit represents 1 tonne of CO2e that an organization can emit.

- The carbon credit market included:

+ Compliance market: formed and regulated by international, regional or national emission reduction systems to realize emission reductions.

+ Voluntary market: operates based on voluntary commitments between organizations and individuals and follows the standards set by the organization recognized. - Management teams that emit less than their limit may resell carbon credits on the corresponding carbon market.

Carbon credits offer organizations a way to reduce emissions while creating new revenue streams. They promote the use of clean energy sources and encourage afforestation, all while strengthening international cooperation between countries.

Carbon Credit, An Excellent Chance for Growth And Success

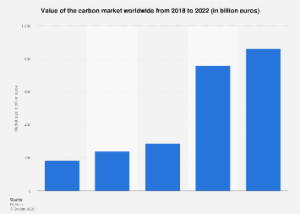

According to Statista, the worldwide carbon market was valued a significant growth in 2021, which reached a record high of 760 billion euros and soared 164%. This growth was mainly due to an increased demand for carbon permits, culminating in surging prices. In 2021, European Union Emissions Trading System accounts for approximately 90% of the global market size.

The value of the carbon market worldwide from 2018 to 2022 (Source: Statista)

The value of the carbon market worldwide from 2018 to 2022 (Source: Statista)

Tesla – A Carbon Credit Leader

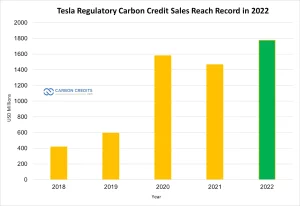

CNN reports that 18 US states have mandated automakers to achieve 70% of their sales as zero-emission vehicles by 2030. Failure to meet this requirement will result in purchasing carbon credits from businesses that surpass regulatory standards, such as Tesla, the top player in the electric vehicle and carbon credit markets as of April 2023.

Tesla regulatory carbon credit sales reach a record from 2018 to 2022

Tesla has generated $1.78 billion in revenue through their clean energy initiatives, which involve installing solar panels and utilizing energy storage systems. This is achieved by leveraging carbon credits sold to other automakers.

Flowcarbon – Utilizes Blockchain Technology to Provide Carbon Credits

Flowcarbon is a startup focused on climate technology founded in the US in 2021. Their innovative approach involves integrating carbon credits into the blockchain, which allows for a more accessible, efficient, and cross-border system for buying and selling CO2 credits in the voluntary carbon market. Flowcarbon recognizes that the current CO2 credit trading system suffers from a lack of clarity, low liquidity, poor accessibility, and transparency in pricing. In May of 2022, Flowcarbon raised $70 million in a Series A round.

Highlight Opportunities: The Carbon Credit Market in Vietnam

Vietnam has taken steps to reduce emissions by participating in various programs, projects, and agreements related to the compliance market. However, the voluntary market is being explored, studied, and developed. Unfortunately, the transfer of forest carbon has faced obstacles and challenges due to gaps in legal, institutional, and management frameworks and as well as a lack of capacity to transfer the carbon credit.

The Ministry of Natural Resources and Environment will release circulars to guide projects operating under the domestic carbon credit clearing mechanism and the greenhouse gas emissions quota exchange in 2025, as Decree 06/2022/ND-CP mandated. Vietnam has planned to launch a domestic carbon credit exchange in 2028, with significant potential in the country’s forest areas. According to the Ministry of Agriculture and Rural Development, Vietnam can provide around 57 million forest carbon credits annually, priced at an average of 5 USD/credit. Resulting in hundreds of millions of dollars in revenue.

Reducing carbon emissions and combating climate change can be achieved using carbon credits. Startups specializing in this field offer solutions that aid organizations and businesses in reducing carbon emissions while creating business value. The high concerns for sustainability will bring a good opportunity for startups.

Contact:

itifund.com

(+84)90 998 3699

info@itifund.com

fb.me/ITIFund