Building Trust and Growth: The Power of Transparency in Startups and Investment Funds

Tuesday, 08/11/2022 09:00 (GTM +7)

The importance of transparency and negotiation in the relationship between investment funds and startups was highlighted by a lawsuit against an enterprise invested by IDGVV 15 Limited and IDG Ventures Vietnam in 2007.

IDG Ventures Vietnam sues VCCorp tech company for alleged governance lapses

IDG Ventures Vietnam sues VCCorp tech company for alleged governance lapses

Qualitative beliefs make investors pump funds faster than other quantitative factors

Qualitative beliefs make investors pump funds faster than other quantitative factors

Investors are often regarded as sponsors of startups, mainly when their business models are in their nascent stages and face challenges in accessing traditional sources of financing. In addition to providing capital, some investors also serve as advisors and partners, sometimes playing a role in the startup’s development that is no less important than the founders. This can lead to the generation of new investment cash flow.

However, when problems arise on the startup side, the business’s image and its leaders’ brand can be significantly affected, making it difficult to establish trust with investors and other partners. Therefore, it is imperative for both parties to be proactive in managing the inflow of cash and to include provisions in the contract that ensure a detailed and specific bank disbursement plan. This level of transparency and negotiation can help to maintain a positive relationship between investors and startups, even in the face of challenges.

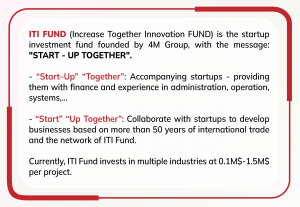

Contact:

itifund.com

(+84)90 998 3699

info@itifund.com

fb.me/ITIFund