Vietnam’s Startup Ecosystem in 2022 and Forecast of 2023

Tuesday, 28/03/2023 09:00 (GTM +7)

Overview of investment capital pouring into Vietnam’s startup ecosystem in 2022

According to Crunchbase News, in the third quarter of 2022, we witnessed a significant surge in global venture capital, with $81 billion. In Southeast Asia, the total amount invested was $3.72 billion, with Vietnam receiving $494 million. This country currently boasts an active startup ecosystem, with 208 venture capital funds, including 40 domestic funds, operating within its borders.

Vietnam’s startup ecosystem currently holds the 54th out of 100 global rankings. However, VNG, VNLife, and Momo were “unicorns” at over $1 billion of 3,800 active startups in this country. Additionally, some others are considered “sub-unicorns,” including Tiki, Trusting Social, Economy Delivery, Kyber Network, Amanotes, KiotViet, and Fast Delivery, as reported by BambuUP.

Total of investment capital and deals over the years in Vietnam (Source: Do Ventures & Cento Ventures)

The significant influx of investment capital into Vietnamese technology startups presents opportunities and challenges to meet business expectations. As a result, Vietnam has made remarkable strides in innovation and is widely recognized as a rising star in Southeast Asia.

The potential of startup investment in Southeast Asia and Vietnam

Despite a decrease in total investment capital, the Southeast Asian market remains a promising destination for investors. The region boasts a large market size of 680 million people and a growth rate of 4-5% per year. As a result, the total value of goods in the digital economy is expected to reach $200 billion by 2022, three years earlier than previously predicted. Additionally, the region is experiencing significant internet growth, with an estimated 20 million new users by 2022, bringing the total to 460 million.

Moreover, Southeast Asia has entered into numerous trade agreements, providing excellent opportunities to reach Asia, Europe, and North America. The Regional Comprehensive Economic Partnership (RCEP) has come into force. The recently signed ASEAN investment facilitation mechanisms and policies are expected to promote sustainable foreign direct investment (FDI) in the region, making it more stable in the long term.

Vietnam has been widely recognized as a rising star in Southeast Asia thanks to several positive factors, such as political stability, a young and skilled workforce, robust infrastructure, and technical expertise. The country is also making significant strides in digitization and innovation, with government support for entrepreneurial ventures.

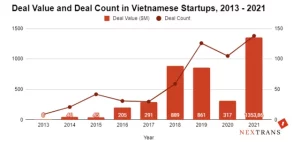

The total of investment deals into Vietnam’s startups through the years (Source: Nextrans)

Investment funds play a crucial role in this development by incubating and accelerating many startups. These funds provide financial support and offer knowledge and expertise in operating, developing, and commercializing products. They also assist Vietnamese startups in reaching out to the international market and contribute to the overall growth of the innovative startup ecosystem. As a result, Vietnam is becoming increasingly attractive and exciting, with a focus on quality and innovation.

Trends of Vietnam’s startup ecosystem in 2023

Mr Nguyen Chi Dung – Minister of Planning and Investment, recently announced at the Vietnam Ventures Summit 2022 that 39 investment funds have committed to investing $1.5 billion in 2023-2035. The total value of Vietnam’s innovative investment during this period is expected to reach $5 billion.

Cloud computing is predicted to be one of the technology investment trends in 2023

Experts predict that investors will exercise greater caution in selecting capital investment projects shortly. However, GlobalData has identified several technology trends likely to attract investment, including AI, cloud computing, cybersecurity, metaverse, cryptocurrency, robotics, IoT, and quantum computing.

Contact:

- 🌏 itifund.com

- 📞 (+84)90 998 3699

- 📩 info@itifund.com

- 🔔 FB.me/ITIFund