Vietnam Innovation & Technology Investment Report 2023

Friday, 07/04/2023 09:00 (GTM +7)

The National Innovation Center (NIC), Forbes Vietnam, and Do Ventures co-organized the Vietnam Innovation Forum on March 30th, 2023, with the theme “Sailing the Digital Sea.” The event also saw the release of the Vietnam Innovation and Technology Investment Report 2023, offering insights into the latest investment trends in Vietnam’s startup ecosystem.

Deputy Minister of Planning and Investment Tran Duy Dong chaired the event, which brought together a diverse group of participants, including investors, technology corporations, and domestic and regional startups such as ThinkZones, Golden Gate Ventures, STIC Investments, ITI Fund, SK Group, and “unicorn” Insider.

Vietnam’s potential and advantages have made it a top destination for startups in Southeast Asia, with high rankings in the Global Innovation Index (GII) and Global Competitiveness Index (GCI). Despite the challenges posed by the Covid-19 pandemic, this remains among the top 50 innovative countries (48/132).

The report provides an overview of the latest investment trends in innovation of Vietnam, highlighting opportunities in the near future, with the following key points:

- Technology experienced a 65% decrease in investment value due to the crisis in Vietnam. However, the number of deals increased, indicating that investment activities continue to occur steadily.

- Fintech received the most investment capital, with a substantial increase of 248%, accounting for 39% of the total investment value, up 4 percentage points compared to 2021. The retail sector took second place, despite a 57% decrease in investment capital compared to 2021.

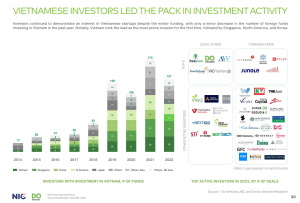

- Domestic investment funds, including ITI Fund, played a significant role in the Vietnamese market in 2022, surpassing foreign funds as the most active group of investors. With increasing influence, these funds continue to play an essential role in the Vietnamese ecosystem.

Vietnam’s fund group becomes the most active investor in the domestic market

Vietnam’s fund group becomes the most active investor in the domestic market

Some active domestic funds in Vietnam.

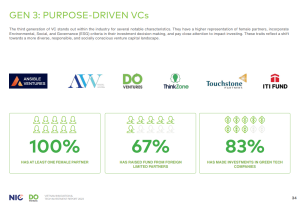

- The emergence of investment funds belonging to the Gen3 – Purpose Driven VCs highlights Vietnam’s growing interest in diversity and social consciousness in the investment landscape. These funds prioritize factors such as a higher percentage of funds that have at least one female leaders (100%), applying Environmental, Social, and Governance (ESG) criteria during project appraisal, paying particular attention to investing in green technology (83%), and owning 36 technology investments worth $73 million by 2022.

Gen3 – Purpose Driven VCs in Vietnam

Furthermore, at this event, 41 venture capital funds pledged to invest $1.5 billion in the Vietnam’s market from 2023 to 2025, with a total investment value expected to reach $5 billion during this period.

Contact:

- 🌏 itifund.com

- 📞 (+84)90 998 3699

- 📩 info@itifund.com

- 🔔 fb.me/ITIFund