WHAT FOUNDERS NEED TO KNOW ABOUT FINANCIAL PLANNING?

Tuesday, 12/04/2022 18:14 (GTM +7)

Financial Planning is an important factor, but startups often pay little attention. Look at some notes in this field with ITI Fund to help start-ups prepare better, especially in funding rounds.

Xem thêm: What Startups Should Know When Valuing In Capital Calls?

Why should startups focus on financial planning?

- Clarified financial planning helps investors trust startups because of transparent and authentic information. In addition, investors can evaluate the feasibility and operating capacity of enterprises.

- Financial planning shows how and when we should use capital. For example, startups that do not have enough money may implement on smaller scale within allowable budget.

- Good financial planning helps founders realize major expenses for maintaining growth momentum and continuously company performance in the future.

- After analyzing the difference between reality and expectation in financial planning, founders can make necessary decisions to achieve business’s goals.

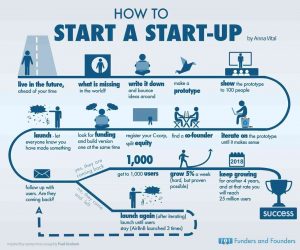

What should startups consider about financial planning at each stage?

- Idea stage: Startups should ensure the source of money by making financial planning for at least six months. Founder also has the blueprint for failing in the future.

- Co-founder stage: At least one of co-founders has financial knowledge and contributes personal capital to increase commitment and responsibility for projects.

- Building prototype and finding market: preparing detailed financial planning and determining capital needs are very necessary because of big expenses in this stage.

- Seed stage: Appearing shares (esoft), angel investors, government funding, and incubators.

- Growth stage: Startups can develop in two directions:

- Founder thinks company can grow in the next 1-2 years without capital call.

- Funding is required to ensure survival, so startups make rounds according to capital needs.

- Exit Stage: Including two common situations:

- Merging and acquiring (M&A) company to large enterprise where startups can add value to their ecosystem.

- IPO (Initial Public Offering)

Startup Stages (Sources: Anna Vital)

Startup Stages (Sources: Anna Vital)

Some financial notes for startups:

- Fundraising issue: At the early stage, the trust and reputation of the founder have a great impact on decisions of investors.

- Times: Startups should prepare financially and capital planning for at least 12-18 months, funding process with investors usually takes 3-6 months, even one year.

- View of loans: Founders need to consider pressure from high-interest loans because distraction can affect the project. Loans are usually suitable for SMEs which already have collateral to ensure solvency.

In conclusion, founders could share entire financial picture, including hidden corners with their partners who can understand and join hands to improve startups.

Source: Collection

Contact:

- 🌏 itifund.com

- 📞 (+84)90 998 3699

- 📩 info@itifund.com

- 🔔 fb.me/ITIFund